Tracking your loan officers' Portfolio at Risk (PAR) is essential to maintaining a healthy loan portfolio.

However, it can be difficult to obtain the data and share reports on the percentage and amount at risk, per loan officer, without considerable manual intervention in the data collection and preparation process.

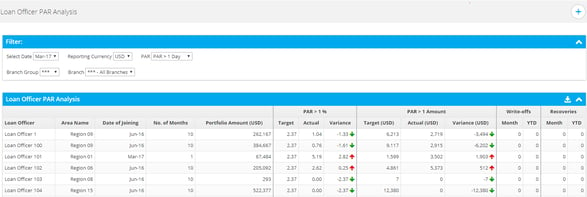

We have introduced the Loan Officer PAR Analysis report to enable you to track the percentage and amount of the portfolio at risk versus pre-defined targets or limits per loan officer.

The report includes the date of joining and the number of months on board as well as details of any write-offs and recoveries.

The report is filterable by region and branch, enabling you to analyse the performance of your loan officers by location.

If you would like to see how this report can provide insight into your financial institution, you can request a free demo here.