By making daily financials available anytime and anywhere, we empower CFOs and CEOs to deliver confident, accurate answers to all stakeholders and transform decision-making.

Let BankBI take care of the heavy-lifting and watch your analytical power soon outstrip the traditional monthly reporting cycle.

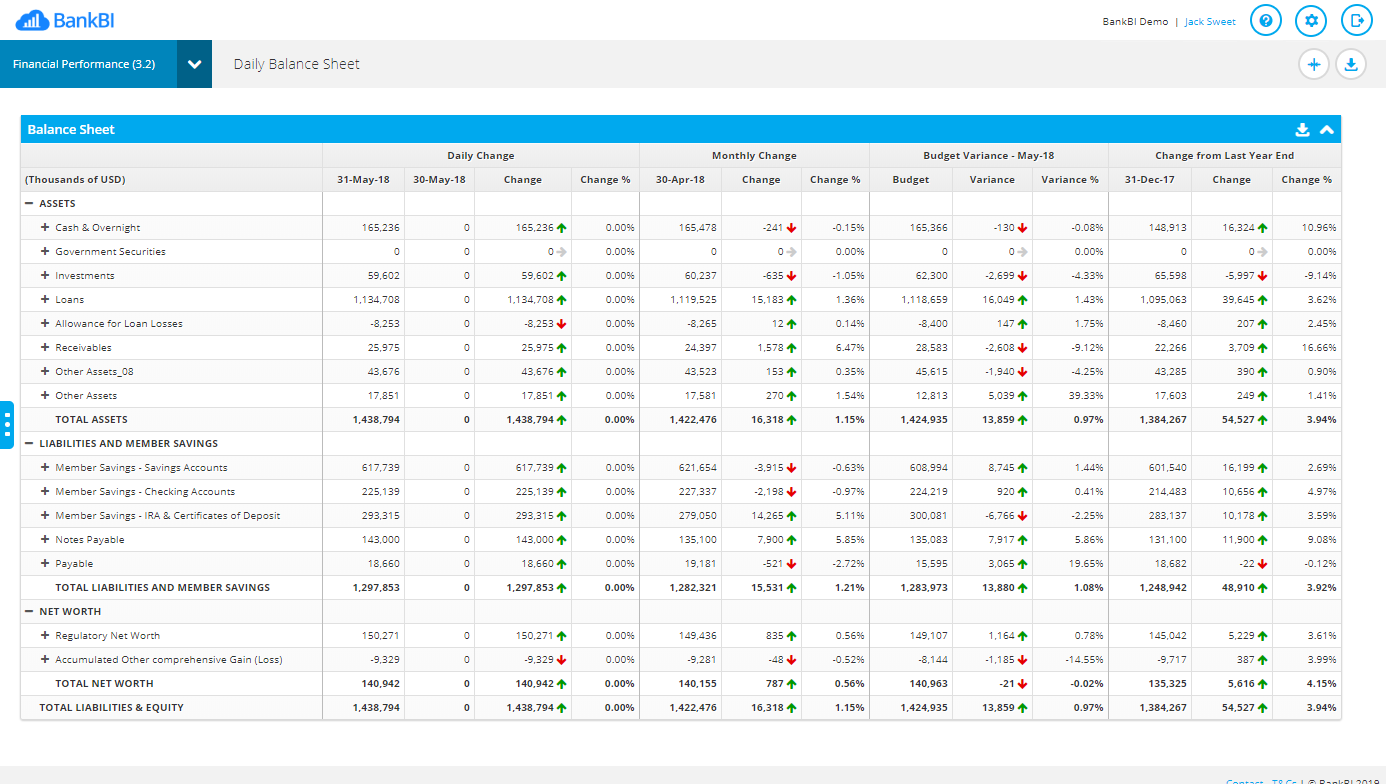

As the frequency of reporting goes up, so too does accuracy and trust in the numbers produced. Our financial performance module lets you report daily on balance sheets and income statements, so you can analyse and predict end of month performance far more precisely – acting on facts rather than hunches.

The daily balance sheet provides an easy way to analyse daily movements in loans and deposits. And since you can access it at any time from a tablet or phone, the need to ask staff to produce ad hoc reports is greatly reduced.

Our powerful dashboard equips you with up-to-date data to share with executive management, enabling you to:

Analyse daily changes in income and expenses with our daily income statement. Not only does it provide a simple way to track interest accruals, it also lets you flag any early warning signs that items may have been booked incorrectly..

Our daily income statement lets you take financial control and pinpoint areas of profitability.

Core banking systems are designed to process and keep records of accounts, loans, and deposits, but they were not designed to be business performance reporting systems. This means many institutions resort to using unmanageable Excel spreadsheets to manually create reports.

But, there’s another way. With our pre-packaged banking and business intelligence software, you can:

Every financial institution is unique, and different board members require differing levels of detail from the monthly report. Some will need at-a-glance oversight, others require in-depth detail of your various portfolios.

At BankBI, we automate the financial processes of banks and credit unions to make them more accurate and less time-consuming – but do so in a different way each time.

We take the time to listen to and understand your distinct needs and set-up, before designing a bespoke solution to match.

“The can-do attitude of BankBI stood out here. We were open to ideas and they really worked with us to make sure that the end product was the best it can be. We are very happy with the result.”

Dennis Bauer, Ideal Credit Union

CFO

Unique to BankBI, our KPI Tree Analysis lets you drill down into financial statements to discover hidden stories:

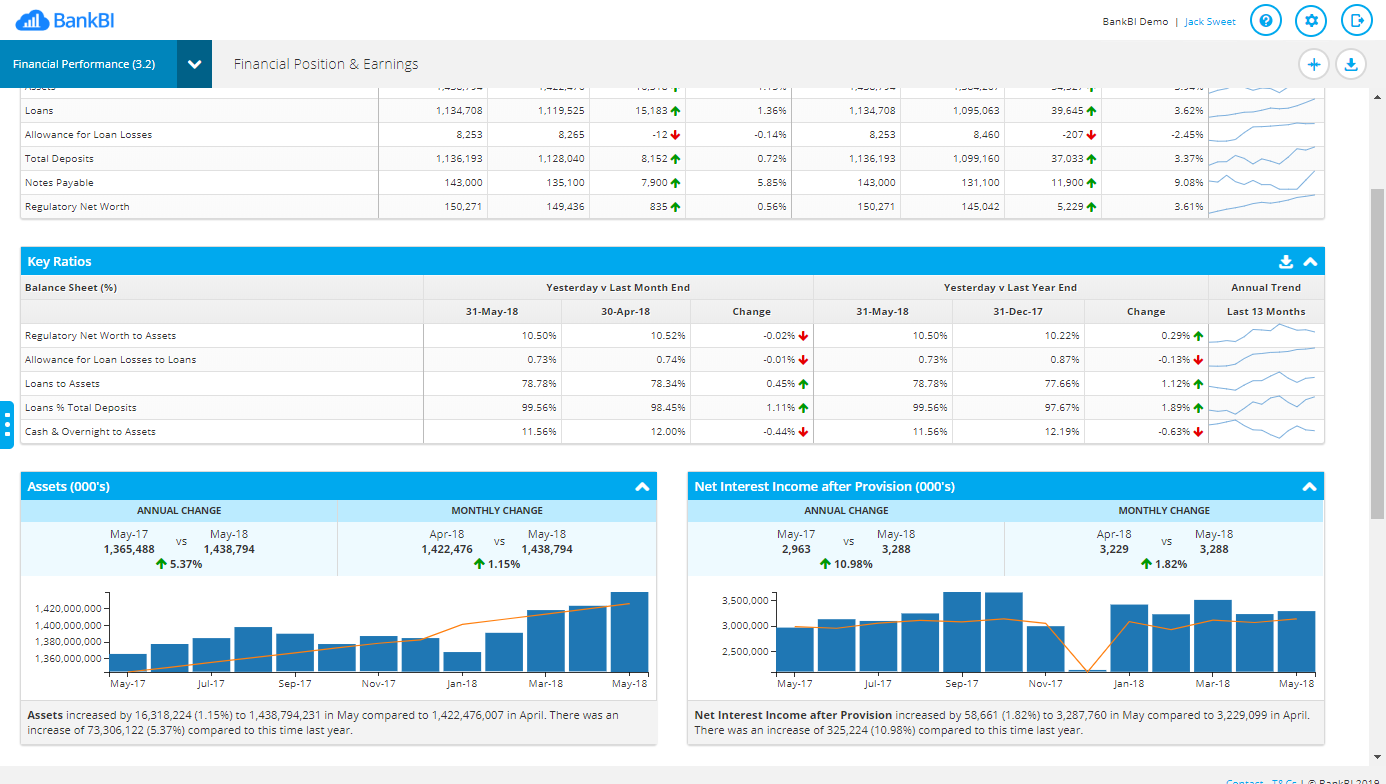

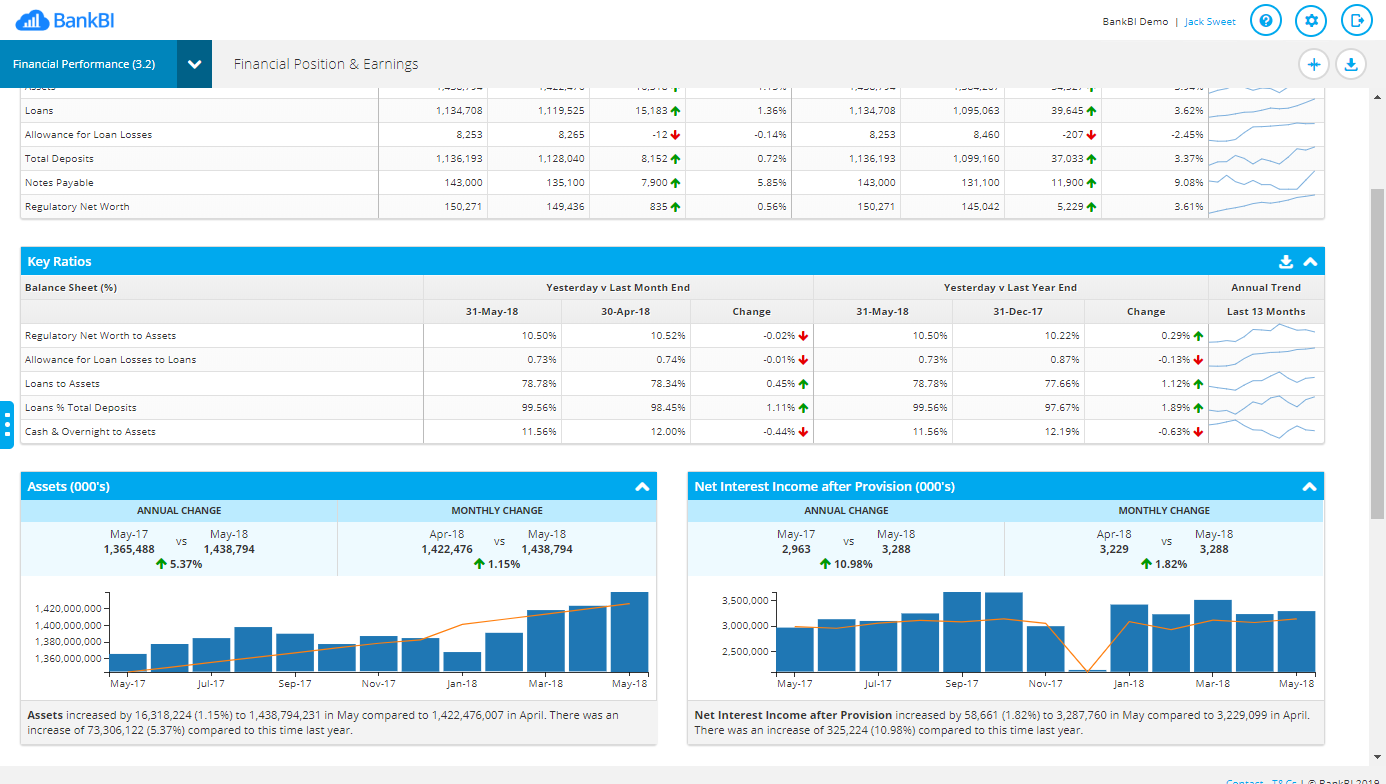

By tracking key performance ratios, it’s easy to see how you’re faring against various strategic goals your company has set. Our financial performance module also lets you gain new insight into your asset portfolio:

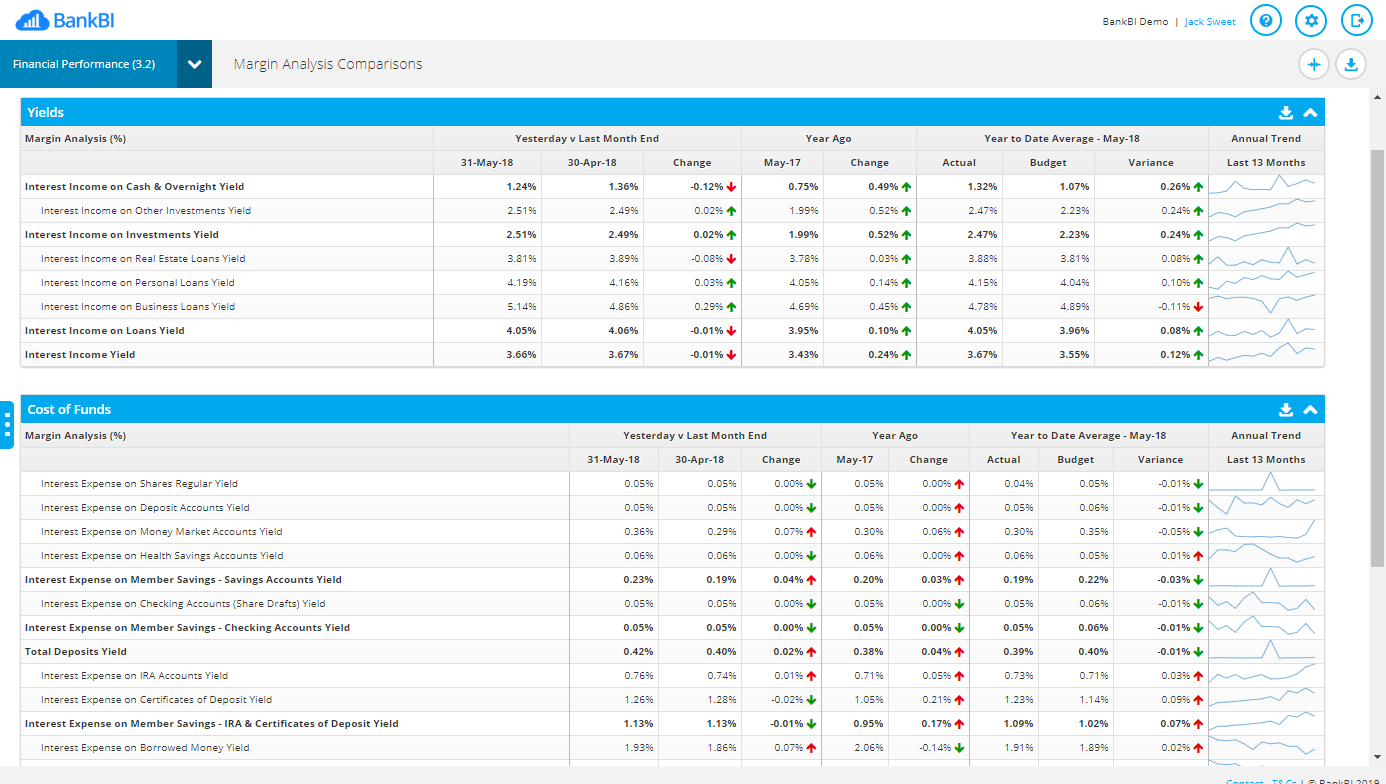

Gain new insight into financial health and track asset and investment performance using yield and margin reporting. Margin analysis comparisons display the yields for investments and loans and the cost of funds for demand and term deposits.

Track the yield on earning assets, interest income yield and net interest margin over a twelve-month period with powerful trend analysis.

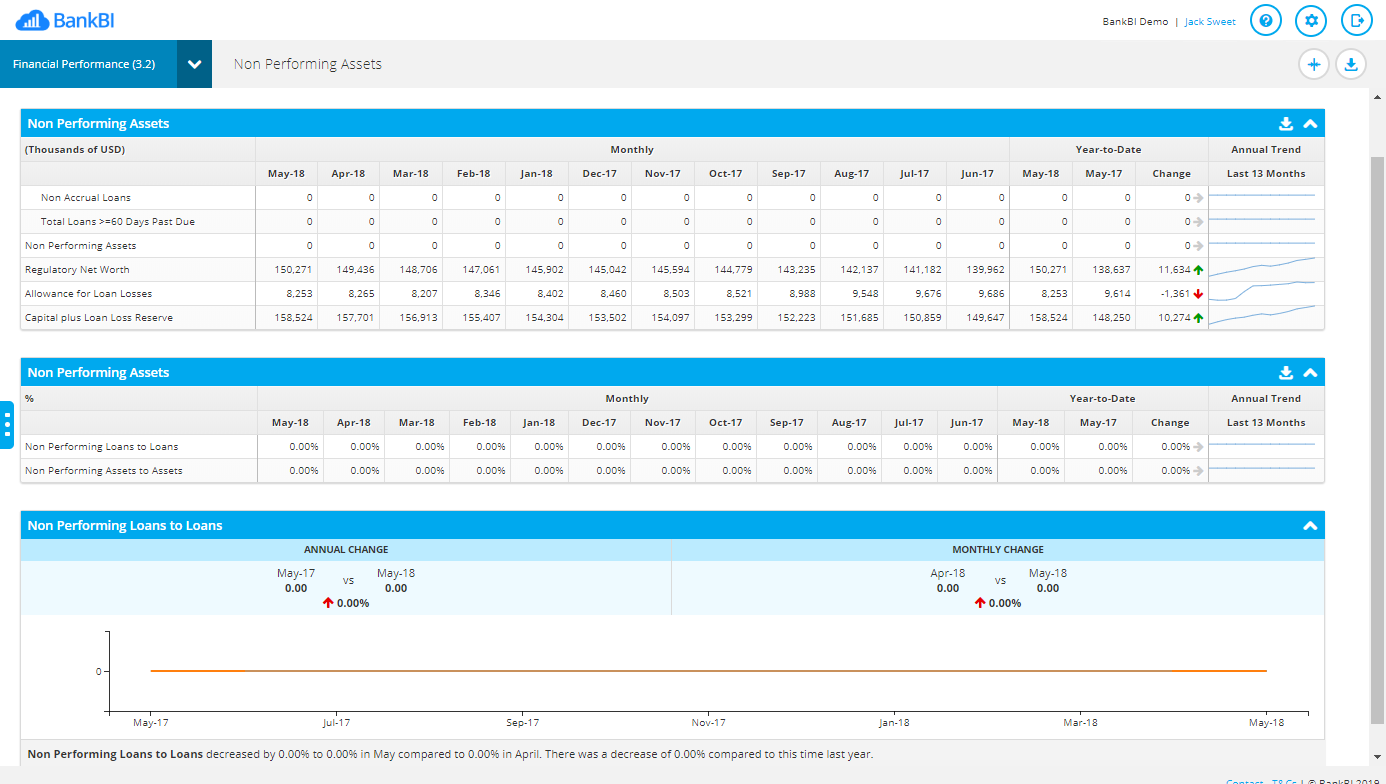

Monitor financial performance and identify at-risk portfolios with past-due asset analysis:

“The solution will provide that deeper level of insight into our performance, ultimately enabling us to make future-forward decisions that mutually benefit us, our members, and our community.”

Christine Tucker, Synergy Credit Union

Chief Financial Officer

“Access both financial performance and banking performance features anytime, anywhere, both at a summary view and a detailed view – at weekends, on the road etc. I love this ability. Daily financials are ready very early in the morning.”

Dennis Bauer, Ideal Credit Union

CFO

“I can go in daily and have that information at my fingertips and in one platform[…]The journey and the project has been very good.”

Rhonda Fullawka, Crossroads Credit Union

Manager of Finance

eBook

Brochure

Case Study

Webinar