Whether you’re a branch manager or part of the C-suite, on the move or at the office, we ensure daily loan and deposit sales figures are always at your disposal – any place and time, on any device.

BankBI helps you answer questions such as:

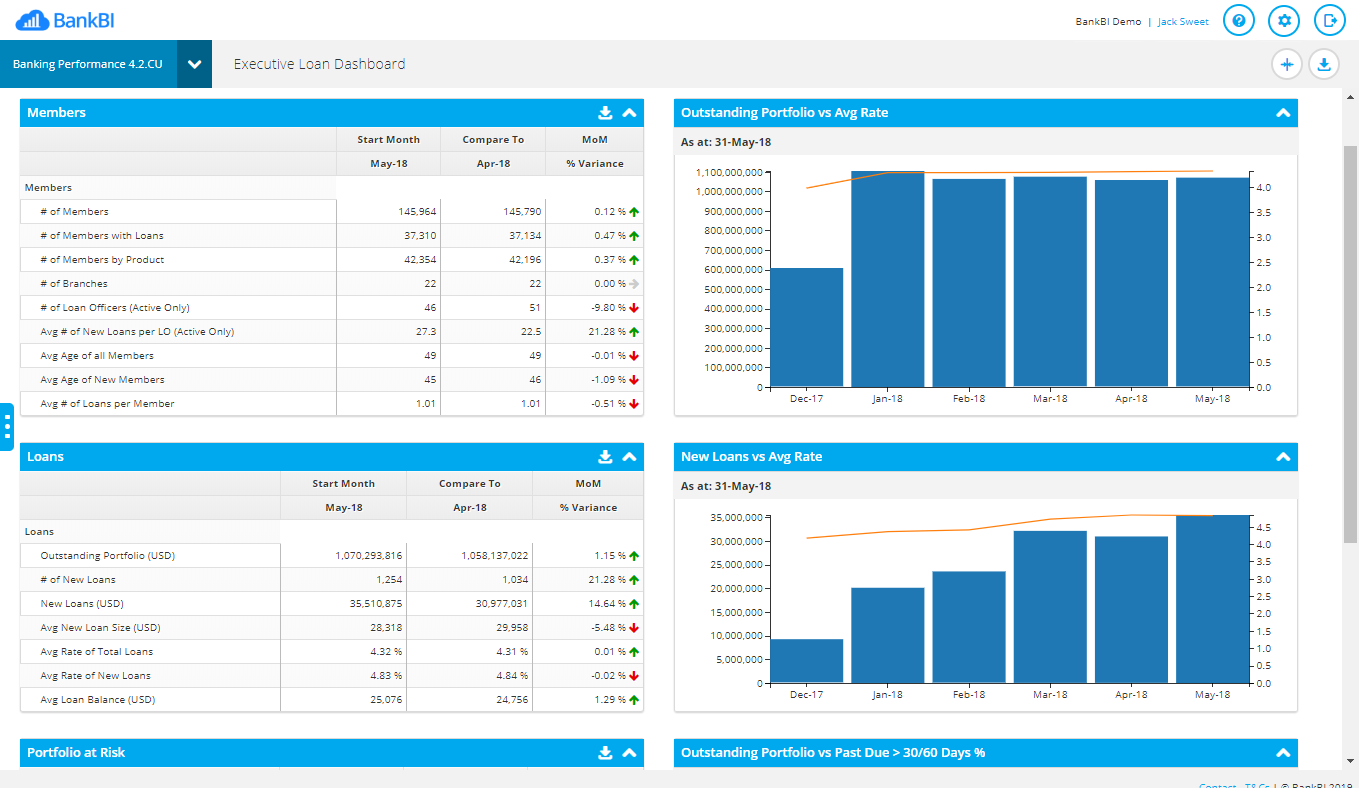

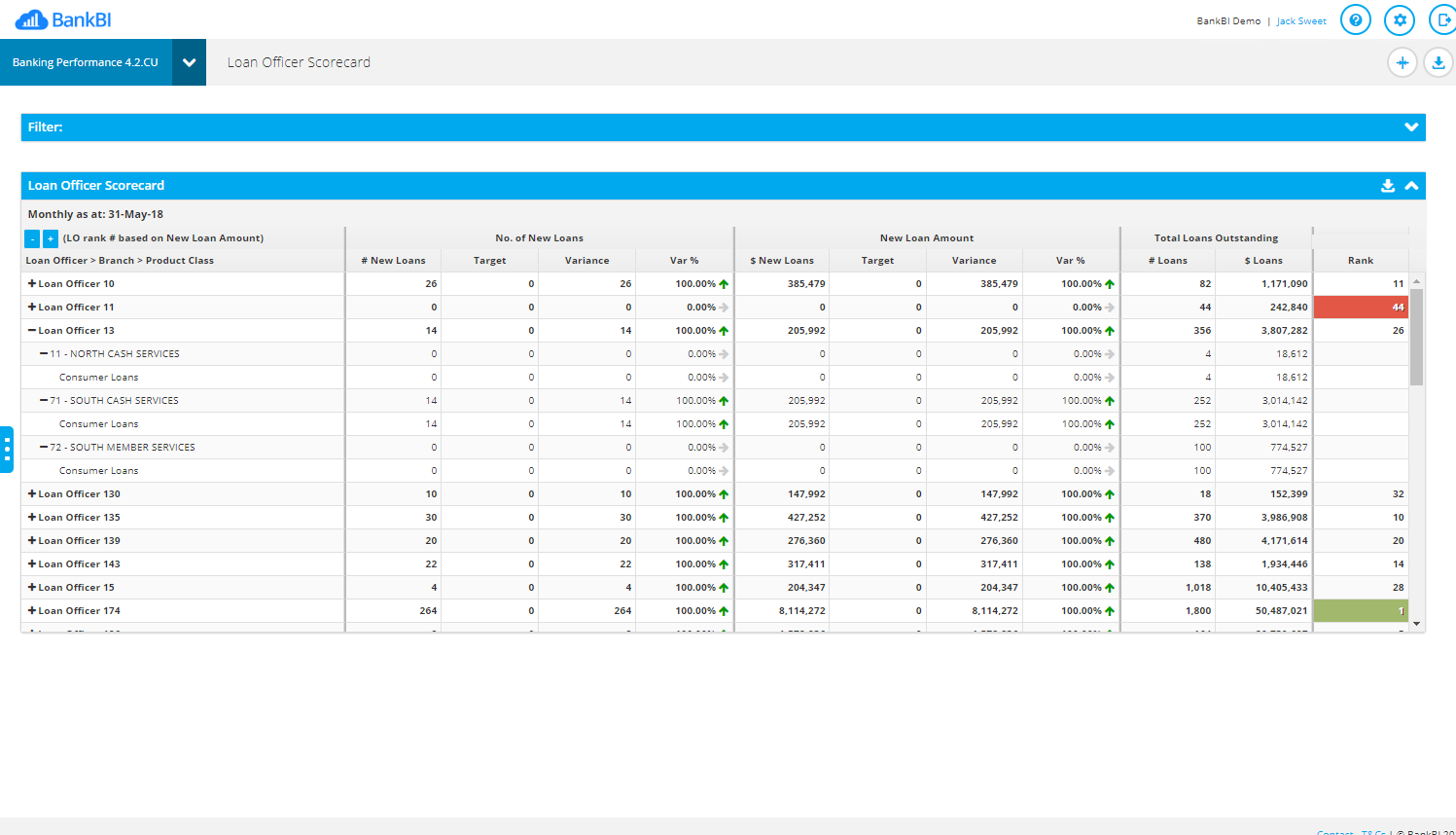

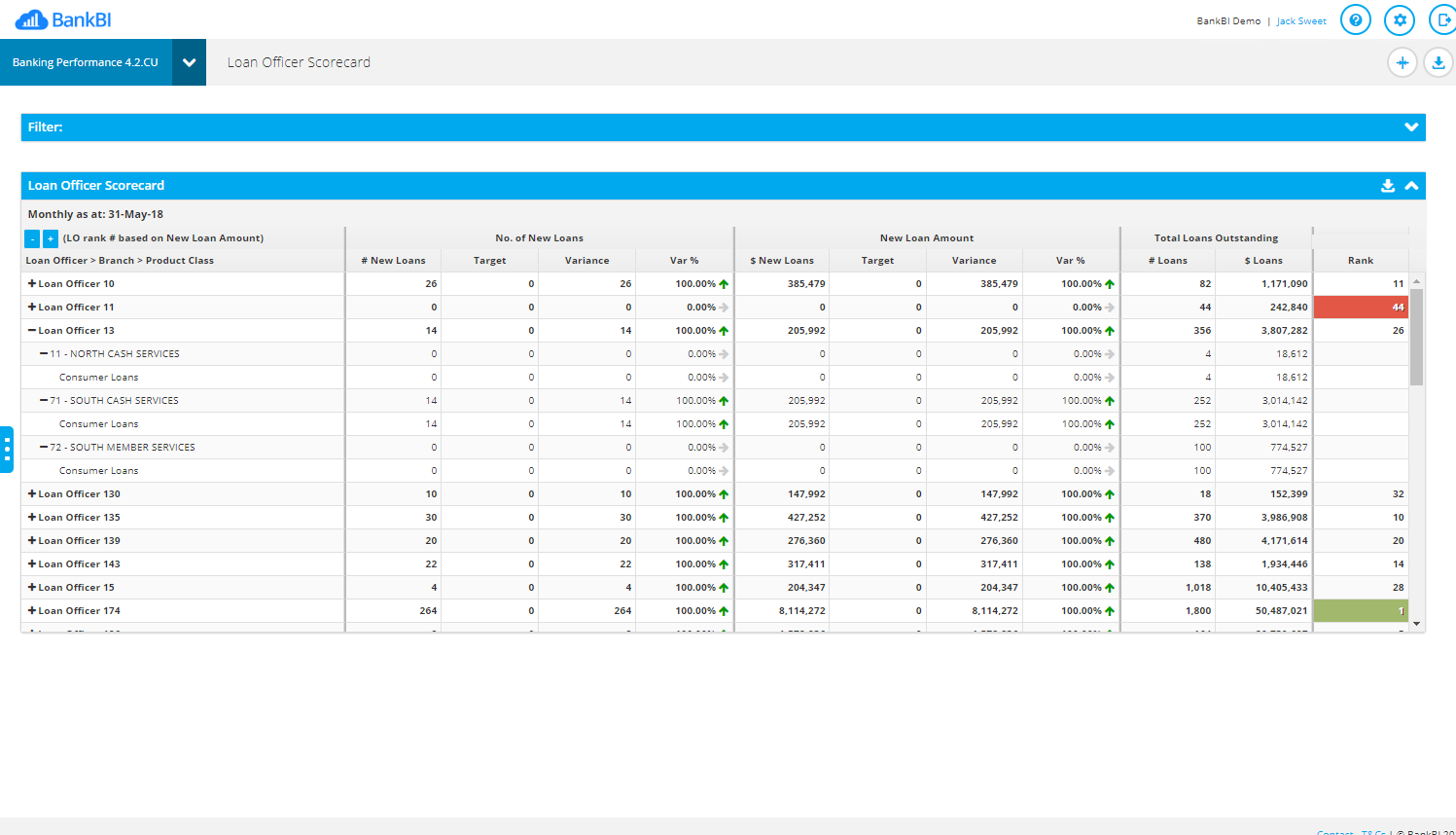

Analyse performance by region, branch, and loan officer by monitoring:

Engage and empower the branch network by giving each member access to their own performance data, updated daily.

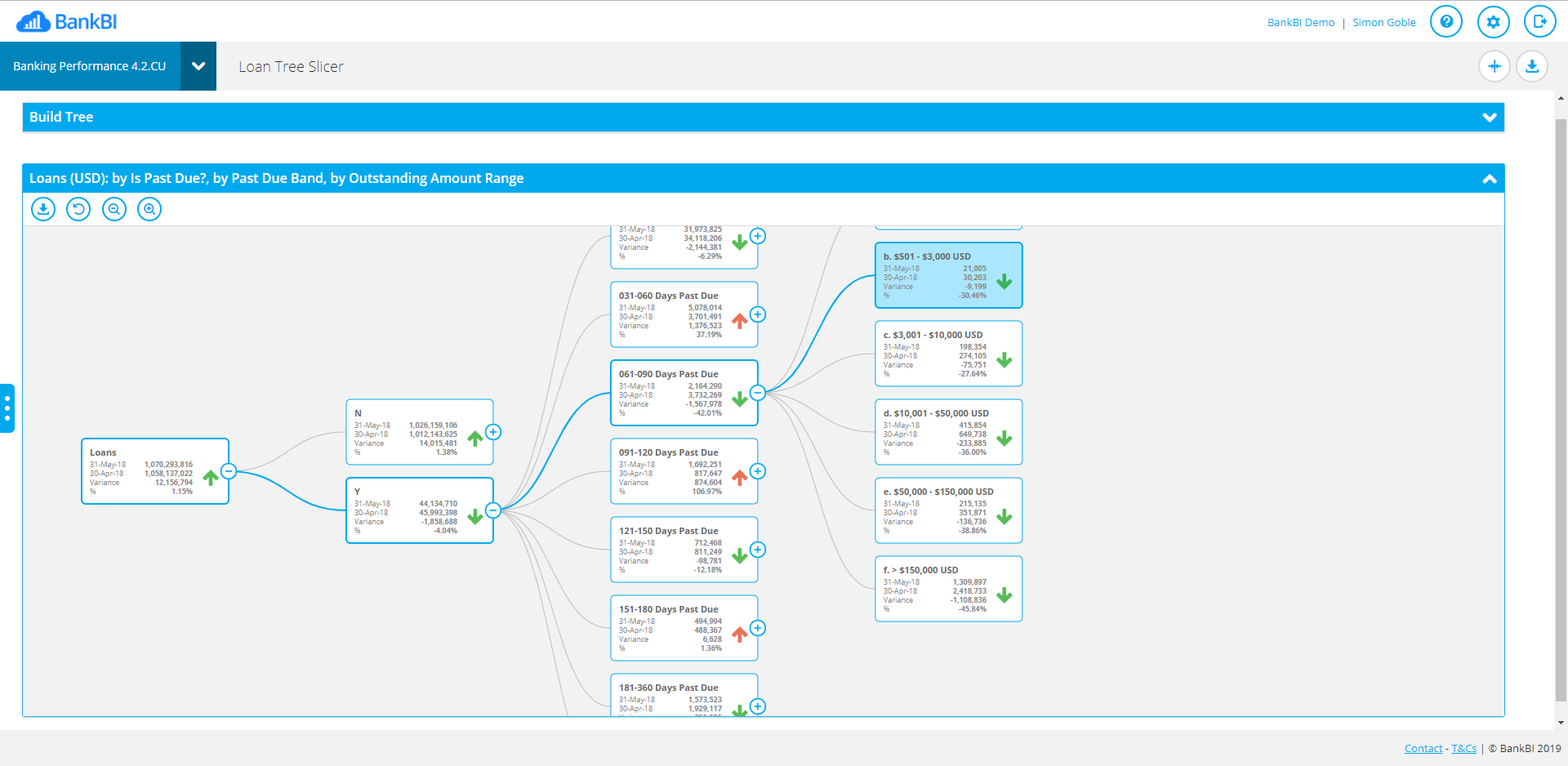

Our diverse range of portfolio at risk, write off, and recovery reports enable you to identify trends over time and answer questions such as "how many loans are past due?" with analysis of balances by past due-days bandings. Once loans go past a certain number of days, our Banking Performance module lets you analyse how many are being written off.

Using analytics to monitor interest rate margins enables you to assess the profitability of the loan portfolio and the cost of funds. And you get the ability to slice and dice by branch, loan officer and profit centres.

Our vintage analysis report lets you assess the changes in quality over time by looking at the loan portfolio by month and year of the origination of the loans. Loans will reflect the credit quality of the loan portfolio at the time of origination, so you can see what effect changes in credit policy have on the portfolio.

Look for anomalies in your data using outlier reports by region, branch and at loan officer level to help identify, understand and plan how to address potential issues as they arise.

“BankBI go the extra mile to get us where we want to be, making informed decisions”

Tom Allen, VisionFund

International Global Director of Change & Programmes

“The solution will provide that deeper level of insight into our performance, ultimately enabling us to make future-forward decisions that mutually benefit us, our members, and our community.”

Christine Tucker, Synergy Credit Union

Chief Financial Officer

“Access both financial performance and banking performance features anytime, anywhere, both at a summary view and a detailed view – at weekends, on the road etc. I love this ability. Daily financials are ready very early in the morning.”

Dennis Bauer, Ideal Credit Union

CFO

“I can go in daily and have that information at my fingertips and in one platform[…]The journey and the project has been very good.”

Rhonda Fullawka, Crossroads Credit Union

Manager of Finance

eBook

Case Study

Webinar

Brochure