Performance management is an integral process for microfinance networks, therefore it’s important that all stakeholders have the right tools to execute it effectively.

What is Performance Management?

Here are two definitions according to a leading research institute and practitioners in the field of performance management:

"Gartner defines “performance management” as the combination of methodologies and metrics that enables users to define, monitor and optimize outcomes necessary to achieve organizational goals and objectives.”

(Follow @Gartner_inc on Twitter)

According to the Advanced Performance Institute and Bernard Marr’s: 7 Secrets of Top Performers “Performance Management is what organisations do to become more successful and stay ahead of their competitors. In fact, managing performance is THE most critical task of any manager or executive.

If organisations get it right, their performance management processes help them to better execute their strategy by measuring, reporting and managing progress. The aim of performance management is to improve the performance of organisations and individuals.”

(Follow @BernardMarr on Twitter)

What Does Performance Management Mean to Microfinance Networks?

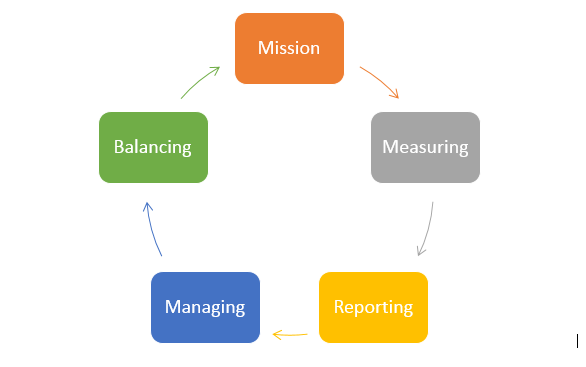

Our definition of performance management for Microfinance Networks adds two key elements to the cycle: balancing and mission – the act of measuring, reporting, managing and balancing financial & social performance to achieve a mission that will support the realisation of a vision.

Performance Management for Microfinance Networks

Performance management is most effective when information can be provided in a user-friendly form.

Using software to automate measuring and reporting is essential for effective performance management that is quick and easy to access and does not require a number of manual interventions or labour-intensive processes.

This ultimately slows down the delivery of information or perhaps even stops it from reaching the individuals that need it most.

In order to achieve an effective level of performance management, microfinance networks need to empower their operational stakeholders with software that has been specifically designed and architected for microfinance networks and their MFIs.

This software should enable head office staff to have a view of the whole network and MFI executive teams to see the performance of their MFI.

This in turn enables them to support their branch managers in managing their performance, which in turn means that branch managers need to be looking at their branch performance and the performance of their loan officers within the same software application.

Critical to the whole cycle is that loan officers need to be able to measure how they are performing against the target each day without compromising time with their clients. This can be achieved by giving loan officers access to the same reporting software as their branch managers, MFI executive teams, and head office.

Ultimately this will ensure that operational stakeholders are all aligned to one single version of the truth and thus are all pulling in the same direction.

Whilst the MFIs operational stakeholders play a huge part in the performance of the MFI and the network, giving all stakeholders (including donors and investors) access to performance reports is key to enabling all stakeholders to influence the all-important balancing act between financial and social performance.