Stay in complete control of your reporting schedule, free up resources, and ensure accurate results with purpose-built regulatory reporting software for banks and credit unions.

Support new regulatory requirements by empowering your finance department to respond to regulatory changes easily and cost-effectively. Our innovative software lets you automate manual tasks and develop business transformation rules to ensure reporting attributes are mapped correctly. Report schedules of loan and deposits are organised by:

a broad array of core banking, general ledger, and data warehouse systems such as Temenos, Fiserv, and Finastra – enabling you to perform higher-quality reporting and analysis with a fully-managed analytics service.

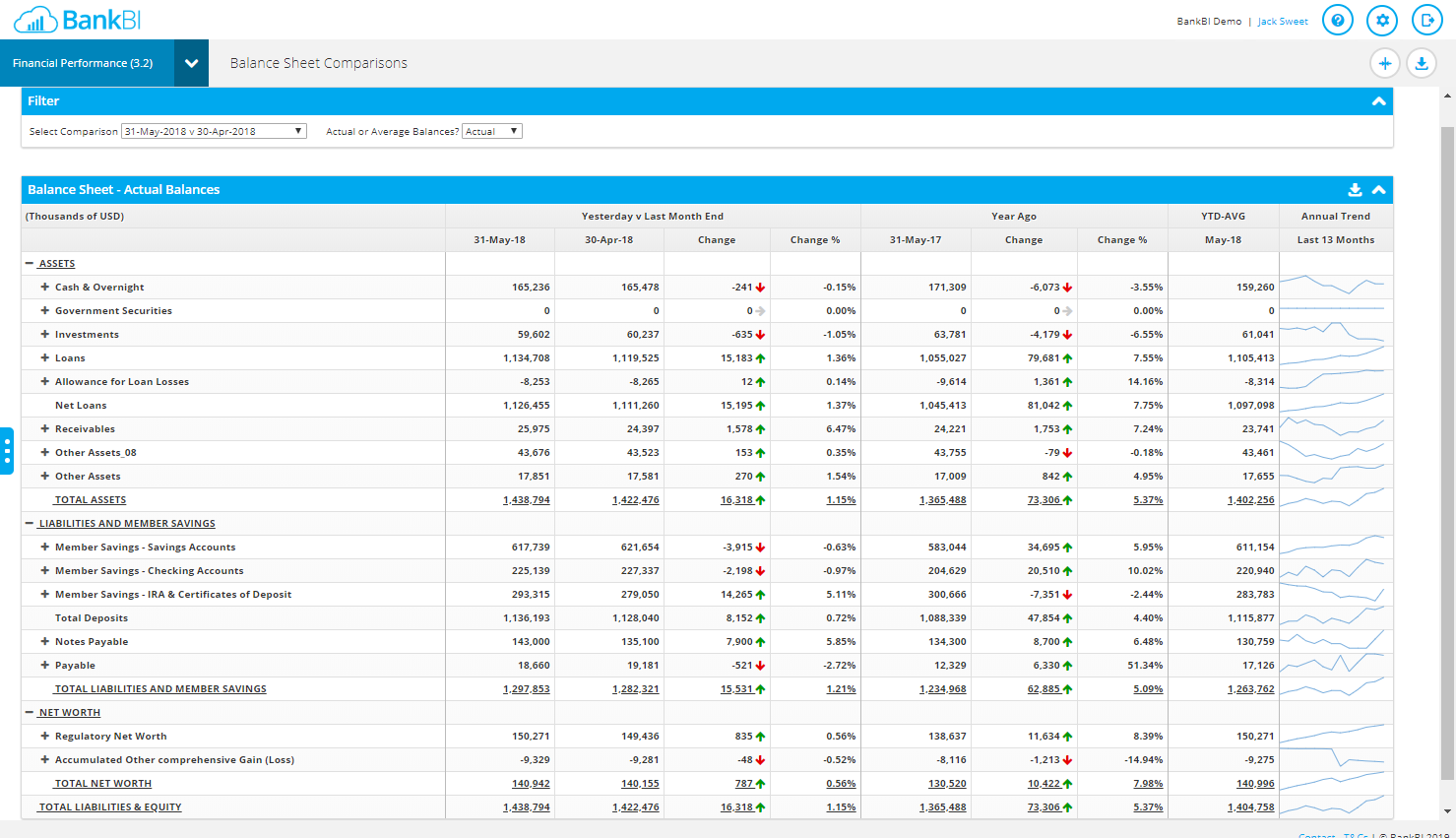

Use the cloud to run the transformation process as a service. Break the balance sheet down into schedules to analyse loan and deposit data at both customer and product attribute level. And, with our intuitive daily extraction tool, you can utilise standard extracts to collect data for:

“We know with BankBI that we will be able to get to a point where we have both financial and loan & deposit analysis delivered in an automated, efficient way with various levels of granularity in an easy to consume and attractive format.”

Dennis Bauer, Ideal Credit Union

CFO

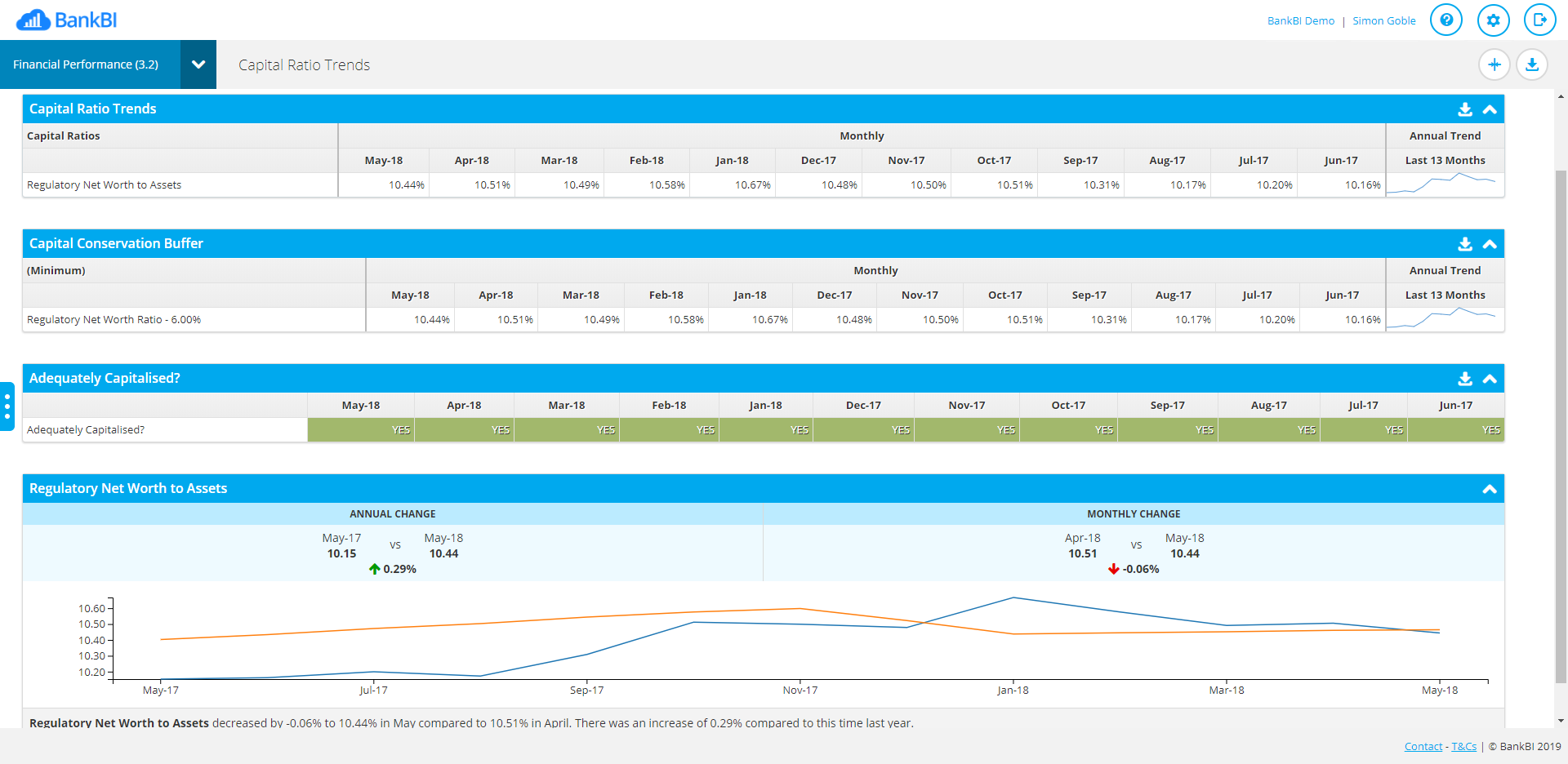

Our powerful tool provides a financial data model that fully supports mapping your bank's general ledger data to the Central Bank chart of accounts. This lets you then reconcile it back to your management accounts without a hitch. By harnessing our cloud technology, you can manage business rules and reconcile accounts to the regulatory balance sheet and income statement with ease.

Eradicate errors and ramp up reporting confidence when you reconcile daily with BankBI.

“The solution will provide that deeper level of insight into our performance, ultimately enabling us to make future-forward decisions that mutually benefit us, our members, and our community.”

Christine Tucker, Synergy Credit Union

Chief Financial Officer

“Access both financial performance and banking performance features anytime, anywhere, both at a summary view and a detailed view – at weekends, on the road etc. I love this ability. Daily financials are ready very early in the morning.”

Dennis Bauer, Ideal Credit Union

CFO

“I can go in daily and have that information at my fingertips and in one platform[…]The journey and the project has been very good.”

Rhonda Fullawka, Crossroads Credit Union

Manager of Finance